Contact a Business Succession Lawyer

Contact Beck & Christian at (949) 855-9250 to make an appointment for a consultation. We will thoroughly review your business and

personal finances and provide experienced advice to help you determine the most advantageous strategies to ensure the successive transfer

of familial wealth.

At Beck & Christian, we’ve been helping families pass on their interests through Business Succession Estate Planning for

35 years. Our clients are secure in the knowledge that the businesses they’ve worked so hard to build and grow will

continue to remain within the family upon retirement, incapacitation or death.

Our seasoned lawyers can help you create a Buy / Sell Agreement, create a charitable trust for taxation purposes, gift

your ownership interest to family members, implement tax strategies that will maximize the retention of business assets

with minimal tax liability, and help you create a comprehensive will or trust to address these issues.

If you have an ownership interest in a business, it is vital that you plan for the future by implementing a business

succession plan. Failure to do so could result in the loss of the business and division within the family. Let our lawyers put

their business, estate and tax planning experience to work for you!

Laguna Hills Business Succession Lawyers

Making a Difference. One Client at a time.

(949) 855-9250

Phone Consultations Available During Coronavirus Restrictions.

The Courts are open and we are working remotely.

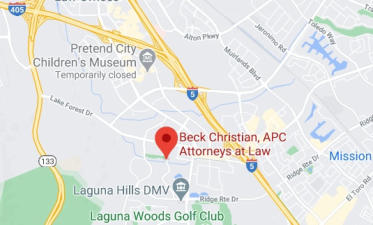

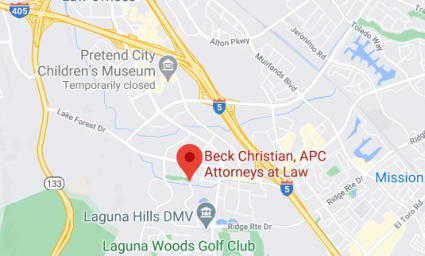

23041 Mill Creek Drive

Laguna Hills, CA 92653

The Laguna Hills Law Firm Beck & Christian has been providing experienced legal counsel to business clients in

and around Laguna Hills for more than 35 years by helping them create and establish business succession

strategies in case of retirement, incapacitation or death.

Expert Tax and Estate Planning Attorneys and highly experienced Business Law Lawyers, Beck & Christian

strive to help you meet your goals by ensuring a smooth transition of ownership through comprehensive Business

Succession Planning, while keeping an eye towards maximizing the retention of wealth and minimizing tax

liability.

Some law firms are extremely large, and they boast about this. However, at Beck & Christian we understand the

basic doctrine that our clients need lawyers who return calls, maintain close contact, and know the value of

establishing a long-term attorney-client relationship. We treat our clients’ matters as we would our own – with

professionalism and courtesy.

Beck & Christian – Laguna Hills Business Succession Attorneys

1. What is a Business Succession Plan?

A Business Succession Plan is an Estate Planning Tool that’s designed to determine how a business, generally a family business or closely held

business, will be operated or dissolved upon the incapacitation or death of the founder.

2. Why do I need a Business Succession Plan?

There are numerous, highly complex issues that may arise upon the death or incapacitation of the individual in charge of running and

operating a business. Business Succession Plans serve to minimize costly litigation by designating who and how a business will be run once

the individual in charge is no longer able to carry out his or her duties. A comprehensive Business Succession Plan should also include how the

business pays state and federal taxes, and under which circumstances the business should ultimately be dissolved.

3. What should my Business Succession Plan include?

Business Succession Plans should set forth detailed information ranging from who should take over daily operations on either a temporary or

permanent basis, to how the business and/or individuals will be taxed based upon the type of entity formed. Additionally, a comprehensive

Business Succession Plan should also include detailed instructions for dissolving the business and strategies for conflict resolution between

feuding parties of interest.

4. Can I draw up my own Business Succession Plan?

Due to the complex nature of both Estate Planning and Taxation, we highly advise against trying to draft your own Business Succession Plan.

A skilled lawyer from Beck & Christian will meet with you to obtain an in-depth understanding of your company, determine the issues most

relevant to your situation, and ascertain areas of potential conflict. Based on this information, we will devise a Succession Plan focused on

protecting every aspect of your business in case of incapacity or death.

5. When should I have a Business Succession Plan drafted?

Failure to institute a comprehensive, well-drafted plan that clearly outlines exactly who will be in charge of managing various aspects of the

business and how the company will either continue to be run or dissolved virtually guarantees that litigation will occur. Therefore, it is

important to have an enforceable Business Succession Plan in place as soon as your company is up and running.

6. How can a Business Succession Plan protect my company from litigation?

Business Succession Plans are created to set forth a path for your company to continue normal operating procedures under the most stressful

of circumstances. A highly detailed Succession Plan can prevent litigation by clearly outlining who will be in charge of business management,

how any management or directorial transitions shall be carried out, and how conflicts between interested parties are to be resolved. Without

these procedures in place, families and business partners who are at odds with one another are more likely to end up litigating their issues in

court.

Business Succession FAQ | Beck & Christian, APC

If you are seeking intelligent and skilled Advanced Estate Planning advice, contact Laguna Hills Estate Planning & Business Succession

Attorneys Beck & Christian at (949) 855-9250 to make an appointment for a consultation. Our attorneys are fully prepared to go the extra

mile for our clients, and make a conscientious effort to always exceed expectations.

A PROFESSIONAL CORPORATION

Making a Difference. One Client at a Time.

Phone Consultations Available During

Coronavirus Restrictions. The Courts are open

and we are working remotely.

23041 Mill Creek Drive

Laguna Hills, CA 92653

Phone: (949) 855-9250

Fax: (949 ) 380 - 1128 email: gbeck@beck-christian.com

Laguna Hills

Business Succession Lawyers

Contact a Business Succession

Lawyer

Contact Beck & Christian at (949) 855-9250 to

make an appointment for a consultation. We will

thoroughly review your business and personal

finances and provide experienced advice to

help you determine the most advantageous

strategies to ensure the successive transfer of

familial wealth.

Business Succession FAQ | Beck

& Christian, APC

1. What is a Business Succession

Plan?

A Business Succession Plan is an Estate

Planning Tool that’s designed to determine

how a business, generally a family business or

closely held business, will be operated or

dissolved upon the incapacitation or death of

the founder.

2. Why do I need a Business

Succession Plan?

There are numerous, highly complex issues

that may arise upon the death or incapacitation

of the individual in charge of running and

operating a business. Business Succession

Plans serve to minimize costly litigation by

designating who and how a business will be

run once the individual in charge is no longer

able to carry out his or her duties. A

comprehensive Business Succession Plan

should also include how the business pays

state and federal taxes, and under which

circumstances the business should ultimately

be dissolved.

3. What should my Business

Succession Plan include?

Business Succession Plans should set forth

detailed information ranging from who should

take over daily operations on either a

temporary or permanent basis, to how the

business and/or individuals will be taxed based

upon the type of entity formed. Additionally, a

comprehensive Business Succession Plan

should also include detailed instructions for

dissolving the business and strategies for

conflict resolution between feuding parties of

interest.

4. Can I draw up my own Business

Succession Plan?

Due to the complex nature of both Estate

Planning and Taxation, we highly advise

against trying to draft your own Business

Succession Plan. A skilled lawyer from Beck &

Christian will meet with you to obtain an in-

depth understanding of your company,

determine the issues most relevant to your

situation, and ascertain areas of potential

conflict. Based on this information, we will

devise a Succession Plan focused on

protecting every aspect of your business in

case of incapacity or death.

5. When should I have a Business

Succession Plan drafted?

Failure to institute a comprehensive, well-

drafted plan that clearly outlines exactly who

will be in charge of managing various aspects

of the business and how the company will

either continue to be run or dissolved virtually

guarantees that litigation will occur. Therefore,

it is important to have an enforceable Business

Succession Plan in place as soon as your

company is up and running.

6. How can a Business Succession

Plan protect my company from

litigation?

Business Succession Plans are created to set

forth a path for your company to continue

normal operating procedures under the most

stressful of circumstances. A highly detailed

Succession Plan can prevent litigation by

clearly outlining who will be in charge of

business management, how any management

or directorial transitions shall be carried out,

and how conflicts between interested parties

are to be resolved. Without these procedures

in place, families and business partners who

are at odds with one another are more likely to

end up litigating their issues in court.

Beck & Christian – Laguna Hills

Business Succession Attorneys

At Beck & Christian, we’ve been helping

families pass on their interests through

Business Succession Estate Planning for 35

years. Our clients are secure in the knowledge

that the businesses they’ve worked so hard to

build and grow will continue to remain within

the family upon retirement, incapacitation or

death.

Our seasoned lawyers can help you create a

Buy / Sell Agreement, create a charitable trust

for taxation purposes, gift your ownership

interest to family members, implement tax

strategies that will maximize the retention of

business assets with minimal tax liability, and

help you create a comprehensive will or trust to

address these issues.

If you have an ownership interest in a

business, it is vital that you plan for the future

by implementing a business succession plan.

Failure to do so could result in the loss of the

business and division within the family. Let our

lawyers put their business, estate and tax

planning experience to work for you!

The Laguna Hills Law Firm Beck & Christian

has been providing experienced legal counsel

to business clients in and around Laguna Hills

for more than 35 years by helping them create

and establish business succession strategies

in case of retirement, incapacitation or death.

Expert Tax and Estate Planning Attorneys

and highly experienced Business Law

Lawyers, Beck & Christian strive to help you

meet your goals by ensuring a smooth

transition of ownership

through comprehensive

Business Succession

Planning, while keeping an

eye towards maximizing the

retention of wealth and

minimizing tax liability.

Some law firms are extremely

large, and they boast about

this. However, at Beck & Christian we

understand the basic doctrine that our clients

need lawyers who return calls, maintain close

contact, and know the value of establishing a

long-term attorney-client relationship. We treat

our clients’ matters as we would our own – with

professionalism and courtesy.

If you are seeking intelligent and skilled

Advanced Estate Planning advice, contact

Laguna Hills Estate Planning & Business

Succession Attorneys Beck & Christian at

(949) 855-9250 to make an appointment for a

consultation. Our attorneys are fully prepared

to go the extra mile for our clients, and make a

conscientious effort to always exceed

expectations.