Laguna Hills Business Tax Attorneys at Beck & Christian have more than 35 years’ experience providing expert tax advice to businesses, and

representing them in State & Federal tax audits and tax controversies. We also offer the following business and corporate tax services to our

clients:

•

U.S. and Foreign Tax Planning

•

Business & Corporate Taxation

•

Business Continuation Agreements

•

Family Business Succession Strategies

•

California Property Taxation

•

California Sales Tax Issues & Audits

•

Tax Issues Arising from Employee Misclassification

•

Payroll Tax Matters

•

Employment Tax Issues

•

Business Formation Selection to Maximize Tax Benefits

•

Tax Strategies with Respect to Business Owned Property

The Laguna Hills Law Firm Beck & Christian is committed to providing the highest quality advice and representation, and we zealously

represent all of our clients’ best interests. We are dedicated to contributing to the success of your business by standing by our promise to not

only deliver cost-efficient expert legal counsel, but also maintain good communication. We will make every effort to return calls by the end of

the business day and respond to our clients’ written correspondence as soon as possible. When you need our services, we will be there for

you.

Welcome to the Laguna Hills Law Firm Beck & Christian. Our experienced business taxation attorneys are highly

qualified in business tax matters. Attorney Greg Beck has earned a Certificate of Specialization in Taxation Law

from the State Bar’s Board of Legal Specialization. Additionally, Greg Beck is a Certified Public Accountant and

Stephen Christian holds a Masters of Law in Taxation.

At Beck & Christian, our lawyers advise businesses in a wide variety of tax issues, and commonly combine

business and tax planning strategies by utilizing alternative business structures to achieve maximum tax benefits

and minimize exposure to tax audits and other tax controversies.

Whether you are just starting a new business venture or have an established business, own a small business or

run a large corporation, the Business Tax Lawyers at Beck & Christian offer a wide variety of corporate and

business tax services to clients throughout Orange County.

Call (949) 855-9250 to schedule a confidential consultation with one of our honest, experienced and skilled Laguna Hills Business Tax

Attorneys today.

Laguna Hills Business Taxation Attorneys

Making a Difference. One Client at a time.

(949) 855-9250

Phone Consultations Available During Coronavirus Restrictions.

The Courts are open and we are working remotely.

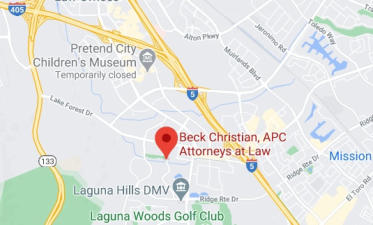

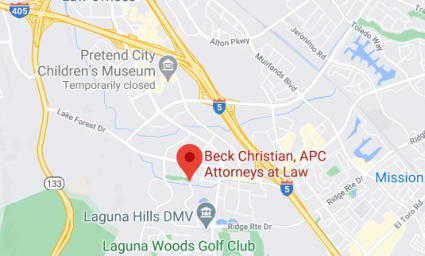

23041 Mill Creek Drive

Laguna Hills, CA 92653

Contact a Qualified Laguna Hills Business Tax Attorney

Contact Laguna Hills Business Taxation Lawyers Beck & Christian by filling out our Business Tax Case Evaluation Form, or call us directly

at (949) 855-9250 to make an appointment for a consultation. Dedicated to helping our corporate and business clients successfully navigate

complex business tax matters since 1978.

Expert Business Tax Lawyers in Laguna Hills

What are Sales Tax Audits?

Every commercial business has the potential to be the target of a sales tax audit. This is an attempt by the State of California to determine

whether a particular business has paid the correct amount of sales taxes. During an audit, the State Board of Equalization will investigate and

search for revenue which was not properly taxed. In addition, they are looking for instances where a business collected the sales tax, but did

not properly remit it to the state. In an audit, the highest priority is to protect your rights, preserve your interests, and resolve the matter in

the most timely and cost-efficient way possible. An experienced business taxation attorney can help you navigate the audit and appeals

process while potentially making a significant difference in the outcome for you and your business.

How are Employment Taxes Paid by Employers?

Employers have the responsibility to calculate and pay taxes to the government for each employee. A business is expected to withhold a

certain amount from the employee’s pay while also contributing funds for certain taxes. This process can be complex because the amount is

based on several variables which are different for each employee. For example, these fixed withholding amounts can vary due to the pay

period and the employee’s filing status. The amount will also depend on the number of withholding allowances an employee has claimed. In

California, employers must maintain compliance by establishing and maintaining current accounts with the California State Employment

Development Department.

How can Employee Misclassification cause Problems?

A business is taxed differently depending on a worker’s employment status. Is a worker classified as an employee, or is the worker an

independent contractor? An independent contractor is not an employee. An independent contractor performs a service that is outside the

company’s regular scope of business. A business must apply several tests put forward in California’s Labor Code when considering how to

classify workers. Recent legislation in California has adjusted the traditional definition of independent contractors. If a business is found to

have misclassified its workers, they may face significant penalties. The State handles these wage violations seriously. Misclassification can

lead to additional payroll tax issues.

What is involved in Business Property Taxation Issues?

California requires businesses to pay property taxes by a certain date each year. These taxes are similar to the manner in which individuals

pay property taxes. The amount due is based on the assessed value of each real estate asset. Failure to comply may lead to harsh fines. It is

necessary for business owners to manage due dates and amounts. The business owner needs to be knowledgeable of the exact items to

include as part of the cost of the asset, such as sales taxes, installation, and freight charges. In addition, the County Assessor’s office may

send an adjustment notice for property values which could increase the amount of taxes due. When a property owner has reason to believe

the taxes are too high, they may file an appeal with the Assessment Appeals Division of the county clerk’s office. If certain restrictions are

met, a business owner may be able to deduct property taxes as a business expense. To avoid business property taxation issues, a business

owner can work with an expert in business taxation issues.

Business Taxation FAQ | Beck & Christian, APC

A PROFESSIONAL CORPORATION

Making a Difference. One Client at a Time.

Phone Consultations Available During

Coronavirus Restrictions. The Courts are open

and we are working remotely.

23041 Mill Creek Drive

Laguna Hills, CA 92653

Phone: (949) 855-9250

Fax: (949 ) 380 - 1128 email: gbeck@beck-christian.com

Laguna Hills

Business Taxation Attorneys

Contact a Qualified Laguna Hills

Business Tax Attorney

Contact Laguna Hills Business Taxation

Lawyers Beck & Christian by filling out our

Business Tax Case Evaluation Form, or call

us directly at (949) 855-9250 to make an

appointment for a consultation. Dedicated to

helping our corporate and business clients

successfully navigate complex business tax

matters since 1978.

Welcome to the Laguna Hills Law Firm Beck &

Christian. Our experienced business taxation

attorneys are highly qualified in business tax

matters. Attorney Greg Beck has earned a

Certificate of Specialization in Taxation Law

from the State Bar’s Board

of Legal Specialization.

Additionally, Greg Beck is a

Certified Public Accountant

and Stephen Christian

holds a Masters of Law in Taxation.

At Beck & Christian, our lawyers advise

businesses in a wide variety of tax issues, and

commonly combine business and tax planning

strategies by utilizing alternative business

structures to achieve maximum tax benefits

and minimize exposure to tax audits and other

tax controversies.

Whether you are just starting a new business

venture or have an established business, own

a small business or run a large corporation,

the Business Tax Lawyers at Beck &

Christian offer a wide variety of corporate and

business tax services to clients throughout

Orange County.

Call (949) 855-9250 to schedule a

confidential consultation with one of our

honest, experienced and skilled Laguna Hills

Business Tax Attorneys today.

Expert Business Tax Lawyers in

Laguna Hills

Laguna Hills Business Tax Attorneys at Beck

& Christian have more than 35 years’

experience providing expert tax advice to

businesses, and representing them in State &

Federal tax audits and tax controversies. We

also offer the following business and corporate

tax services to our clients:

•

U.S. and Foreign Tax Planning

•

Business & Corporate Taxation

•

Business Continuation Agreements

•

Family Business Succession Strategies

•

California Property Taxation

•

California Sales Tax Issues & Audits

•

Tax Issues Arising from Employee

Misclassification

•

Payroll Tax Matters

•

Employment Tax Issues

•

Business Formation Selection to Maximize

Tax Benefits

•

Tax Strategies with Respect to Business

Owned Property

The Laguna Hills Law Firm Beck & Christian is

committed to providing the highest quality

advice and representation, and we zealously

represent all of our clients’ best interests. We

are dedicated to contributing to the success of

your business by standing by our promise to

not only deliver cost-efficient expert legal

counsel, but also maintain good

communication. We will make every effort to

return calls by the end of the business day

and respond to our clients’ written

correspondence as soon as possible. When

you need our services, we will be there for

you.

Business Taxation FAQ | Beck &

Christian, APC

What are Sales Tax Audits?

Every commercial business has the potential

to be the target of a sales tax audit. This is an

attempt by the State of California to determine

whether a particular business has paid the

correct amount of sales taxes. During an

audit, the State Board of Equalization will

investigate and search for revenue which was

not properly taxed. In addition, they are

looking for instances where a business

collected the sales tax, but did not properly

remit it to the state. In an audit, the highest

priority is to protect your rights, preserve your

interests, and resolve the matter in the most

timely and cost-efficient way possible. An

experienced business taxation attorney can

help you navigate the audit and appeals

process while potentially making a significant

difference in the outcome for you and your

business.

How are Employment Taxes Paid by

Employers?

Employers have the responsibility to calculate

and pay taxes to the government for each

employee. A business is expected to withhold

a certain amount from the employee’s pay

while also contributing funds for certain taxes.

This process can be complex because the

amount is based on several variables which

are different for each employee. For example,

these fixed withholding amounts can vary due

to the pay period and the employee’s filing

status. The amount will also depend on the

number of withholding allowances an

employee has claimed. In California,

employers must maintain compliance by

establishing and maintaining current accounts

with the California State Employment

Development Department.

How can Employee Misclassification

cause Problems?

A business is taxed differently depending on a

worker’s employment status. Is a worker

classified as an employee, or is the worker an

independent contractor? An independent

contractor is not an employee. An

independent contractor performs a service

that is outside the company’s regular scope of

business. A business must apply several tests

put forward in California’s Labor Code when

considering how to classify workers. Recent

legislation in California has adjusted the

traditional definition of independent

contractors. If a business is found to have

misclassified its workers, they may face

significant penalties. The State handles these

wage violations seriously. Misclassification

can lead to additional payroll tax issues.

What is involved in Business

Property Taxation Issues?

California requires businesses to pay property

taxes by a certain date each year. These

taxes are similar to the manner in which

individuals pay property taxes. The amount

due is based on the assessed value of each

real estate asset. Failure to comply may lead

to harsh fines. It is necessary for business

owners to manage due dates and amounts.

The business owner needs to be

knowledgeable of the exact items to include

as part of the cost of the asset, such as sales

taxes, installation, and freight charges. In

addition, the County Assessor’s office may

send an adjustment notice for property values

which could increase the amount of taxes due.

When a property owner has reason to believe

the taxes are too high, they may file an appeal

with the Assessment Appeals Division of the

county clerk’s office. If certain restrictions are

met, a business owner may be able to deduct

property taxes as a business expense. To

avoid business property taxation issues, a

business owner can work with an expert in

business taxation issues.