Contact an Expert Estate Planning Lawyer from Beck & Christian

Whether you are the owner of a closely held company or have established a significant amount of wealth and want to draft a comprehensive

Advanced Estate Plan to provide for your heirs and minimize the tax consequences, contact Laguna Hills Estate

Planning Attorneys at Beck & Christian by calling (949) 855-9250 or complete our case evalation form.

At Beck & Christian, we are highly knowledgeable with respect to all Advanced Estate Planning techniques and thoroughly understand the tax

consequences of each. By working with our clients to obtain a clear and concise picture of their business and financial interests, we will

determine the most effective way to implement a comprehensive estate plan.

At Beck & Christian, we are highly knowledgeable with respect to all Advanced Estate Planning techniques and thoroughly understand the tax

consequences of each. By working with our clients to obtain a clear and concise picture of their business and financial interests, we will

determine the most effective way to implement a comprehensive estate plan.

Our expert and skilled lawyers provide legal counsel in a broad range of Advanced Estate Planning matters, and can help you devise and

establish the following:

Laguna Hills Advanced Estate Planning Attorneys

Making a Difference. One Client at a time.

(949) 855-9250

Phone Consultations Available During Coronavirus Restrictions.

The Courts are open and we are working remotely.

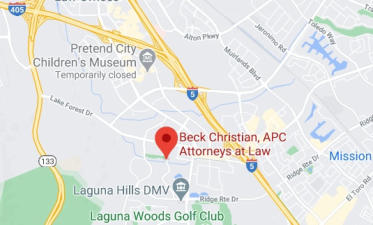

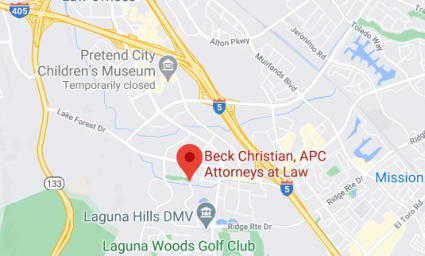

23041 Mill Creek Drive

Laguna Hills, CA 92653

The Law Firm Beck & Christian helps clients preserve their assets, avoid probate, minimize tax consequences, and

maximize the transfer of wealth to successive generations through the use of Advanced Estate Planning techniques.

Attorney Stephen Christian and Greg Beck have been serving the needs of successful individuals and providing

clients with peace of mind since 1978. Attorney Beck is certified by the California State Bar’s Board of Legal

Specialization as an Estate Planning Specialist.

Contact Laguna Hills Advanced Estate Planning Lawyers Beck & Christian today at (949) 855-9250 to schedule a

consultation with one of our skilled Estate Planning Attorneys. We differentiate ourselves from the large law firms

by providing highly personalized service, and enjoy long-term relationships with our clientele. We are dedicated to

going the extra mile for all of our clients, and work diligently to exceed expectations. At Beck & Christian, we help

contribute to your success by offering cost-effective legal assistance in a timely and professional manner.

Advanced Estate Planning Techniques in Laguna Hills

•

Grantor Retained Interest Trusts

•

Irrevocable Life Insurance Trusts

•

Irrevocable Trusts

•

Protective Trusts

•

Qualified Personal Residence Trusts

•

Revocable Trusts

Laguna Hills Advanced Estate Planning Lawyers at Beck & Christian have been helping clients protect and preserve assets accumulated via

their interests in a closely held company, successful investment planning, retirement accumulation, inheritance or executive compensation

packages for 35 years.

•

Charitable Estate Planning

•

Charitable Lead Trusts

•

Charitable Remainder Trusts

•

Dynasty Trusts

•

Family Limited Partnerships

•

Generation Skipping Trusts

A PROFESSIONAL CORPORATION

Making a Difference. One Client at a Time.

Phone Consultations Available During

Coronavirus Restrictions. The Courts are open

and we are working remotely.

23041 Mill Creek Drive

Laguna Hills, CA 92653

Phone: (949) 855-9250

Fax: (949 ) 380 - 1128 email: gbeck@beck-christian.com

Laguna Hills Advanced Estate

Planning Attorneys

Contact an Expert Estate Planning

Lawyer from Beck & Christian

Whether you are the owner of a closely held

company or have established a significant

amount of wealth and want to draft a

comprehensive Advanced Estate Plan to

provide for your heirs and minimize the tax

consequences, contact Laguna Hills Estate

Planning Attorneys at Beck & Christian by

calling (949) 855-9250

or complete our case

evaluation form.

Contact Laguna Hills Advanced Estate

Planning Lawyers Beck & Christian today at

(949) 855-9250 to schedule a consultation

with one of our skilled Estate Planning

Attorneys. We differentiate ourselves from the

large law firms by providing highly

personalized service, and enjoy long-term

relationships with our clientele. We are

dedicated to going the extra mile for all of our

clients, and work diligently to exceed

expectations. At Beck & Christian, we help

contribute to your success by offering cost-

effective legal assistance in a timely and

professional manner.

Advanced Estate Planning

Techniques in Laguna Hills

At Beck & Christian, we are highly

knowledgeable with respect to all Advanced

Estate Planning techniques and thoroughly

understand the tax consequences of each. By

working with our clients to obtain a clear and

concise picture of their business and financial

interests, we will determine the most effective

way to implement a comprehensive estate

plan.

At Beck & Christian, we are highly

knowledgeable with respect to all Advanced

Estate Planning techniques and thoroughly

understand the tax consequences of each. By

working with our clients to obtain a clear and

concise picture of their business and financial

interests, we will determine the most effective

way to implement a comprehensive estate

plan.

Our expert and skilled lawyers provide legal

counsel in a broad range of Advanced Estate

Planning matters, and can help you devise

and establish the following:

•

Charitable Estate Planning

•

Charitable Lead Trusts

•

Charitable Remainder Trusts

•

Dynasty Trusts

•

Family Limited Partnerships

•

Generation Skipping Trusts

•

Grantor Retained Interest Trusts

•

Irrevocable Life Insurance Trusts

•

Irrevocable Trusts

•

Protective Trusts

•

Qualified Personal Residence Trusts

•

Revocable Trusts

Laguna Hills Advanced Estate Planning

Lawyers at Beck & Christian have been

helping clients protect and preserve assets

accumulated via their interests in a closely

held company, successful investment

planning, retirement accumulation, inheritance

or executive compensation packages for 35

years.

The Law Firm Beck & Christian helps clients

preserve their assets, avoid probate, minimize

tax consequences, and maximize the transfer

of wealth to successive

generations through the

use of Advanced Estate

Planning techniques.

Attorney Stephen Christian

and Greg Beck have been serving the needs

of successful individuals and providing clients

with peace of mind since 1978. Attorney Beck

is certified by the California State Bar’s Board

of Legal Specialization as an Estate Planning

Specialist.